2.12.1.1. T-Bill Quotes

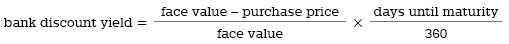

Because Treasury bills are issued at a discounted price and do not offer periodic interest payments, their quotes are different from those of Treasury bonds. Treasury bills are quoted as a bank discount yield. The bank discount yield is the annualized ratio of the bill’s discount to its face value. It is calculated as follows:

The yield represents the discount to par value the investor receives. A dealer will wish to buy at a larger discount and sell at a smaller discount. For this reason, when a T-bill spread is quoted, the bid will be higher than the ask. So you m